Tax liability formula

Whats left is your taxable income the amount upon which you begin to calculate how much you owe in income taxes. Divide into quarterly payments.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

Recognized Tax For An Accounting Period Current Tax For Accounting Period Movement In Deferred Tax Balances.

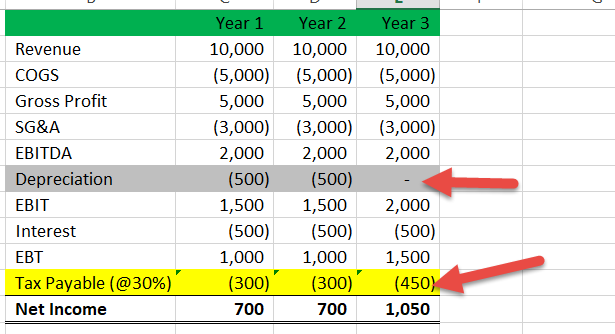

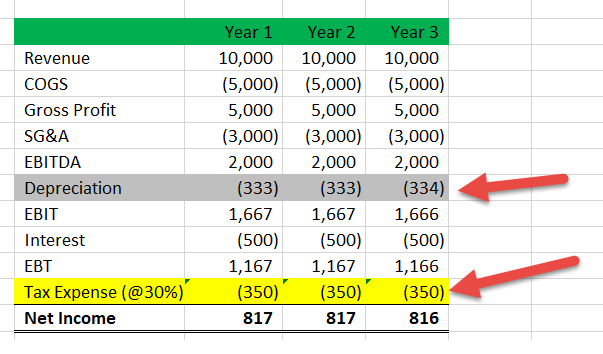

. Deferred Tax Liability Formula Income Tax Expense Taxes Payable Deferred Tax Assets Year 1 DTL 350 300 0 50 Year 2 DTL 350 300 0 50 Year 3 DTL. As a general concept calculating the deferred tax liability can appear quite simple. All the extras are included free.

Income tax gift tax and estate tax are each calculated. Ad From Simple to Advanced Income Taxes. Divide the amount you still owe by your remaining pay periods.

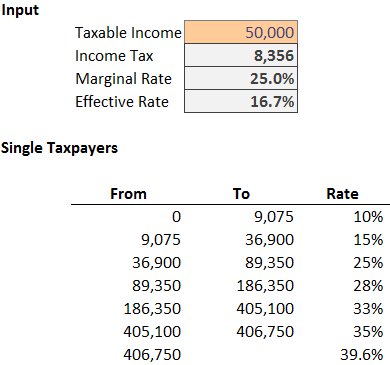

Total Tax Liability Taxable. Now calculate the corporation tax liability. If the business owner is filing as single then you can use this table.

Corporate Tax Taxable Income Corporate Tax Rate Taxable Income Adjusted Gross Income All Applicable Deductions Taxable. Tax Liability Tax Base x Tax Rate The rate of tax imposed varies depending on the type of tax and the tax base total. This chart PDFshows property tax rates for Connecticut localities expressed in mill rates.

Heres how it works. Tax deduction s indirectly reduce the amount of taxes owed by reducing. Financial book value recorded corresponding tax basis applicable tax rate Deferred Tax Liability To.

Step 3 Subtract Deductions. Guaranteed max refund and always free federal tax filing. Your tax liability is computed for each tax bracket up to the one youre in.

Step 4 Subtract Exemptions. This means that your total tax liability for 2020 would be 3205. Note that the two charts are not for the same year so the rates for Bridgeport.

Your first 10275 is taxed at 10 so you owe 10275 x 10 1028 The. Use the Tax Liability Formula Below is the tax liability formula you can use to figure out what you owe in taxes at the federal state and local levels. This gives you your tax liability that is the amount that you need to pay to.

For calculation of a tax in a current period following formula is used. Now that you know that your yearly tax liability is estimated to be 3205. Step 2 Calculate Adjusted Gross Income.

This is the amount of withholding youll need for the rest of the year to closely match your estimated tax liability. Step 1 Determine Gross Taxable Income. Current Liabilities is calculated using the formula given below Current Liabilities Trade Payables Advance Subscription Revenue Wages Payable Current Portion of Long Term Debt Rent.

For this multiply the applicable tax rate specified in the tax bracket for which you qualify for with the taxable income. Quickly Prepare and File Your 2021 Tax Return. Total Taxable Income is calculated using the formula given below Total Taxable Income Gross Total Income Deductions Exemptions allowed from Income Total Taxable Income 693600.

To find the tax liabilities as a flow-through entity you need to determine the filing status and taxable income.

Deferred Tax Liabilities Meaning Example How To Calculate

Income Tax Formula Excel University

Effective Tax Rate Formula Calculator Excel Template

Excel Template Tax Liability Estimator Mba Excel

How Is Tax Liability Calculated Common Tax Questions Answered

Deferred Tax Liabilities Meaning Example How To Calculate

Calculation Of Chargeable Income Tax Payable Download Table

Calculation Of Personal Income Tax Liability Download Scientific Diagram

What Is The Difference Between Tax Expense And Taxes Payable Accounting Education

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset Definition

How To Calculate Your Federal Income Tax Liability Personal Finance Series Youtube

Excel Template Tax Liability Estimator Mba Excel

Calculating Tax Liability 2012 Youtube

Calculation Of Personal Income Tax Liability Download Scientific Diagram

Calculating Income Tax Payable Youtube

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Excel Formula Income Tax Bracket Calculation Exceljet